Read more about the possibilities

of Variable Pension

Investing your pension capital for a Variable Pension

- If you are retiring and want to purchase pension benefits, you can choose between fixed life-long or variable pension benefits.

- With variable pension benefits, you choose to invest your pension capital at your own risk.

- This offers a chance of higher pension benefits, but also a chance of lower pension benefits. The amount of your pension benefits is redetermined each year.

Does Variable Pension suit your needs?

Yes

- You want to take a chance on receiving higher pension benefits and are willing to take the risk that your pension benefits could also be lower.

- And you have sufficient other financial means to ensure that your spending pattern will not be put at risk if your variable pension benefits prove to be significantly lower.

- And you don’t mind your pension benefits varying from one year to the next.

- Your partner also wants to receive variable pension benefits in the event that you pass away.

No

- Your total income is about the same as your desired spending. If your variable pension benefits decrease, you will have to cut your expenses more than you would like.

- A decrease in your variable pension benefits will cause financial problems.

- You want certainty regarding the amount of your pension benefits and might lie awake at night knowing that your benefits may decrease or

- Your partner does not want to receive variable pension benefits in the event that you pass away.

A brochure for a more detailed description of the objective and target group of Variable Pension can be downloaded here.

Please note!

As of 1 November 2024, you will no longer be able to apply for a Variable Pension from Centraal Beheer PPI. You can contact an insurer of your choice for this. For example: Centraal Beheer.

You can choose a fixed or variable pension benefit. Centraal Beheer is our standard insurer for a fixed pension benefit. More information can be found on the website of Centraal Beheer.

Are you interested in Variable Pension? Please seek advice!

- We believe it is important for you to carefully consider whether Variable Pension suits your needs.

- To do so, you need to properly understand the opportunities and risks involved in this product and how these apply to your situation.

- We also believe it is important for you to properly understand how Variable Pension works if you decide that it suits your needs.

- An expert pensions adviser can help you with this.

- This is why you can only apply for Variable Pension from Centraal Beheer PPI through an independent adviser.

For advice on Variable Pension, please contact one of the pensions advisers with whom Centraal Beheer PPI works. They understand our product and are aware of similar and alternative products offered by other providers.

Naturally you can also get advice from your own financial adviser.

You will be charged advisory fees for pension advice. These must be paid directly to your adviser.

About Variable Pension

- Variable Pension offers you life-long pension benefits. We recalculate your pension benefits each year, using factors that change every year. For more information, see the section How your pension is determined below. As a result, the amount of your pension will vary from year to year. That is why this pension product is called Variable Pension.

- We invest your pension capital in shares and bonds, so that your pension capital can continue to increase during your retirement. As a result, your pension benefits may increase over time. However, the return on the investments may also be disappointing, or even negative. This means that your pension benefits could also decrease.

- The interest rate is an important factor in determining the amount of your pension benefits. Because the benefits are determined annually, you benefit when the interest rate increases. At the same time, a decrease in the interest rate works to your disadvantage.

- With a ‘fixed pension’, by contrast, the amount of the pension benefits is determined at the time the pension is purchased. The benefits from this pension do not change for the rest of your life. The amount of this pension therefore strongly depends on the interest rate at the time you purchase the pension.

- Variable Pension is a pension product that you can only purchase with the pension capital that you, as employee, have accrued with your employer in a collective pension scheme.

- The pension capital is accrued in a ‘defined contribution scheme’, which allows you to choose the provider from which you want to purchase a pension product on the date of your retirement.

- You can choose to purchase a fixed pension or variable pension benefits. Centraal Beheer PPI only offers Variable Pension.

- You can also decide to purchase entitlement to a partner’s pension at the same time. Your partner will then receive life-long pension benefits in the event that you pass away. This pension also provides variable pension benefits that will amount upon commencement to 70% of your Variable Pension at the time of your passing away.

- Variable Pension offers a chance of higher benefits as compared to fixed pension benefits. However, you also run the risk of receiving lower pension benefits than you would have received if you had opted for fixed pension benefits.

- As you get older, you will probably have fewer opportunities to earn extra income if your pension proves to be disappointing. It is therefore important for you to carefully consider how much certainty you want regarding your pension.

-

Variable Pension is suitable for you if:

- You want to take a chance on receiving higher pension benefits and are willing to take the risk that your pension benefits may also prove to be lower.

- And you have sufficient other financial means to ensure that your desired spending pattern will not be put at risk if the Variable Pension benefits are significantly lower.

- And you don’t mind your pension benefits varying from year to year and

- Your partner also wants to receive variable pension benefits in the event that you pass away.

-

Variable Pension is not suitable for you if:

- Your total income is about the same as your desired spending If your variable pension benefits decrease, you will have to cut your expenses more than you would like.

- A decrease in your Variable Pension benefits will cause financial problems.

- You want certainty about the amount of your pension benefits and are worried that your pension may decrease or

- Your partner does not want to receive Variable Pension in the event that you pass away.

- We will determine the amount of your pension benefits for the coming year by December at the latest.

-

The amount depends on:

- The interest rate. The interest rate is used to estimate the future return on investments. The higher the interest rate, the higher the pension. The lower the interest rate, the lower the pension.

- The life expectancy. If the general life expectancy changes, we must adjust the variable pension benefits accordingly in the annual determination of the amount of the pension.

- Bonus on life. For as long as you live, we will add an amount to the value of your investments every year. With the bonus on life, we purchase additional investments for your pension. You get the bonus on life because we do not pay out – part of – the value of your investments in the event that you pass away.

- The return on your investments in the past year.

- The ‘decrease percentage’. We take an annual decrease in the pension into account. This allows us to initially pay out higher benefits as compared to a fixed pension. We try to make up this decrease by achieving returns on the investments. If the return on the investments is higher than the decrease percentage, the pension benefits will increase. If the return is lower than 1.3%, the pension benefits will decrease.

- The ‘spread’. In the calculation, we spread the annual change in the return on investments, the interest rate and the mortality rate over four years. This limits the impact that large fluctuations in these factors will have on the annual amount of your pension. We will apply a shorter spread period as you grow older.

- Partner’s pension or not: you can also take out a partner’s pension. If you do, your partner will receive lifelong variable pension benefits if you pass away. This pension is also a variable pension benefit and will amount to 70% of your Variable Pension upon your passing away. This pension applies only to your legal partner upon commencement of the Variable Pension.

- Commencement date: the pension can commence on the first day of any month during the year. After the pension has commenced, we will determine the amount of your pension benefit for the coming year in December at the latest.

- The payment frequency: you can have the pension paid out every month, every quarter or every year. The costs vary per payment frequency. For more information, see the section “What are the costs”.

- The capital you contribute: you can choose how much pension capital you want to contribute. The minimum is € 10,000.-. You can also purchase a combination of a Variable Pension and a fixed pension benefit from a pension insurer.

- A 30-day cooling-off period. After that, you are bound by Variable Pension. If you change your mind, you can decide not to proceed with, and therefore discontinue, Variable Pension within thirty days after we have received a reply form signed by you. After these 30 days or if we have paid you the first payment earlier, the choice for Variable Pension becomes final. In that case, we will, on your request, transfer your pension capital to the pension administrator you choose. The investment result achieved during that period, whether positive or negative, will accrue to you.

- Investment risk. Investing involves risk. We invest your pension capital so that you have a chance of receiving a higher pension benefit. However, investing also involves a chance of negative investment returns. This risk is for your account. As a result, you also run the risk of a lower pension benefit.

- Interest-rate risk We base the calculation of your pension benefit on the current interest rate. If the interest rate has fallen, this will have a negative effect on the amount of your pension benefit.

- Risk of increasing life expectancy. We’re living longer and longer, which is, of course, a good thing. But as people live longer, pensions will have to be paid out longer too. If the pension capital remains the same, these pensions can only be paid out if the pension benefits are reduced.

- Risk of low mortality rate. The bonus on life is the actual annual addition to your pension capital due to the release of the pension capital of deceased clients of Variable Pension. If this is lower than expected based on the population’s life expectancy, this will have a negative effect on the amount of the pension. We have taken out insurance to reduce this risk.

- Inflation risk. Variable Pension is designed to provide pension benefits in euros that remain approximately the same over time. Due to inflation, a euro will be worth less over time. You should therefore keep in mind that, with Variable Pension, you will be able to purchase less over time.

-

An annual administration fee:

- For a monthly benefit: € 68.89 per year (2025).

- For a quarterly benefit: € 60.83 per year (2025).

- For an annual benefit: € 56.30 per year (2025).

- These amounts are indexed annually by 2%.

-

The annual investment costs are approximately 0.43% of the pension capital:

- Of which, 0.30% management costs will be withdrawn from the pension capital once a year

- Approximately, 0.12% fund costs will be deducted from the investment return of the funds.

-

We invest your pension capital in investment funds with a mix of shares and bonds.

- The shares ensure that you have a chance of achieving additional return. Your pension capital can grow and you will then receive a higher pension benefit than with a fixed pension benefit. But you also run the risk of the shares decreasing in value.

-

The bonds will stabilize the pension benefits.

- They will ensure that your pension capital will not decrease too much in poorer market conditions.

- When interest rates fall, bonds increase in value. This partly offsets the downward effect of lower interest rates on your pension benefits.

- The mix of shares and bonds has been composed in such a way that Variable Pension will give you a realistic chance of a structurally higher pension benefit compared to a fixed pension. The extent of the possible annual decline is also limited. For this, you can consult the fluctuation meter in the ‘standard model’. You can upload this when you fill in the calculation tool to calculate the amount of your Variable Pension.

-

We will invest your pension capital in these investment funds:

- Achmea IM ESG Diversified Return Fund - Shares and high-risk bonds;

- Achmea IM ESG Diversified Fixed Income Fund - Green corporate and government bonds.

- You do not need to decide how you want to invest your pension capital. We will invest it for you in a mix of these funds. We do so in this ratio:

- When you turn 86, we reduce the investment risk to the Achmea IM ESG Diversified Fixed Income Fund over four years.

- Based on the pensions adviser’s advice, your adviser must send us a request for an offer for Variable Pension, stating your details (and your partner’s, if you also want to take out a partner’s pension).

- We will send our offer to your adviser. If you agree to this offer, we will transfer your pension capital to your pension account. If your capital is held by another pension administrator, you must submit a request for a value transfer to Centraal Beheer PPI.

- The pension benefit can commence in any month of the year. The final calculation of the pension benefit will be made shortly before its commencement and will be based on the amount of the pension capital. You will then be given access to your pension portal, where you can track the amount of your pension capital.

With Variable Pension, you purchase lifelong pension benefits. The pension will be paid out until you pass away. If you have taken out a partner’s pension, the benefits will pass to the partner for whom you have taken out the pension benefits. On commencement, the partner’s pension will amount to 70% of the pension upon your passing away.

You can choose to have the pension paid out every month, every quarter or every year. The costs vary per payment frequency.

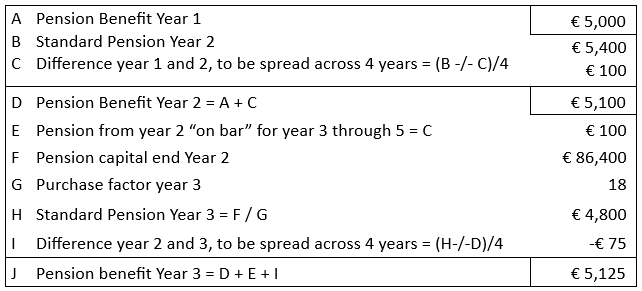

The amount of your pension benefits will be redetermined annually. This will be done as follows.

- Your standard pension for the coming year is determined in December at the latest by dividing the available pension capital by the “purchase factor”.

- The purchase factor is determined by the current interest rate at that time and the life expectancy for your age group.

-

Your pension benefit is determined by the spread between your standard pension and your pension benefit for the preceding year.

- Your standard pension is compared to your pension benefits for the preceding year. A quarter of the difference between the two is added to the pension for the preceding year. The remaining three quarters are retained for payment in the next three years. In this way, we spread out the pension result over four years.

- In addition, we also add the value of spreads from previous years to the pension benefit

-

A calculation example:

The pension capital that remains after you have passed away will be used for your partner’s pension, if you have taken out a partner’s pension for your partner and your partner is still alive at that time.

Otherwise, your pension capital will devolve to the other clients of Variable Pension of Centraal Beheer PPI.

If you have accrued capital in different pension schemes, you can use the combined capital to purchase a single variable pension benefit. One condition, however, is that the pension capital should have been accrued in defined contribution schemes in the second pillar.

Have you accrued pension capital in a 'gross' pension plan? Then we will withhold payroll tax from your pension. Through the tax return, you can check whether sufficient income tax was paid for you.

If you have accrued the pension capital in a net pension scheme, you have already paid income tax on this capital and no longer owe any income tax.

You have a 30-day cooling-off period. After these 30 days, or if we have paid you the first payment earlier, you can no longer change the Variable Pension. If you change your mind within 30 days after placing your signed offer on your pension portal and we have not yet made a payment, you can still stop the Variable Pension. In that case, we will, on your request, transfer the remaining pension capital to the pension administrator you choose. The investment result achieved during that period, whether positive or negative, will accrue to you.

- Life expectancy is important when determining the amount of your pension benefit. The higher the life expectancy, the lower the pension – as a certain capital must be spread over a longer period of time.

- The life expectancy we use is based on the general life expectancy in the Netherlands. The Royal Dutch Actuarial Association (Koninklijk Actuarieel Genootschap) publishes new estimates in this regard every two years.

- We also make an adjustment to the general life expectancy for the population of people who participate in Variable Pension. In general, that population lives a bit longer than average.

- Finally, we make an adjustment for the ratio of men and women in the population of people who participate in Variable Pension. Women generally live longer. The law prohibits us from making a distinction between the life expectancy of men and women in our pension calculations, which is why we use ‘gender-neutral’ life expectancy. This is a weighting of the life expectancy of men and women in proportion to their share of the population of people who participate in Variable Pension.

Yes, we pay pension to clients living outside the Netherlands. However, to some countries we do not pay pension, namely countries to which an international sanctioning policy applies. See sanction measures for a list.

If you live in the Netherlands, we will receive a message via the Personal Records Database when you pass away. Do you live abroad? Then we ask you to send us a 'attestatie de vita' every year. This proves that you are alive. We can then continue to pay out your pension. You can download the 'attestatie de vita' form via your personal pension portal or request it from our Service Desk.

If we do not receive a attestatie de vita from you, we will stop your pension payment until you have submitted the attestatie de vita to us.

- If you are getting divorced during retirement, you must make arrangements with your ex-partner about how your income will be divided. If you do not make any arrangements with your ex-partner, the statutory rules apply. See ‘Getting divorced or terminating your registered partnership’ for more information. We will continue paying the pension to you.

- If you pass away and you had taken out a partner’s pension upon commencement of the pension, the partner’s pension will be paid to your ex-partner for whom you have taken out the partner’s pension.

- Once you have retired, you cannot have the partner’s pension taken out pass to a partner other than the partner for whom you originally took out the partner’s pension.

- If your ex-partner pass away before you, the pension capital for partner's pension will be added back to your pension capital.